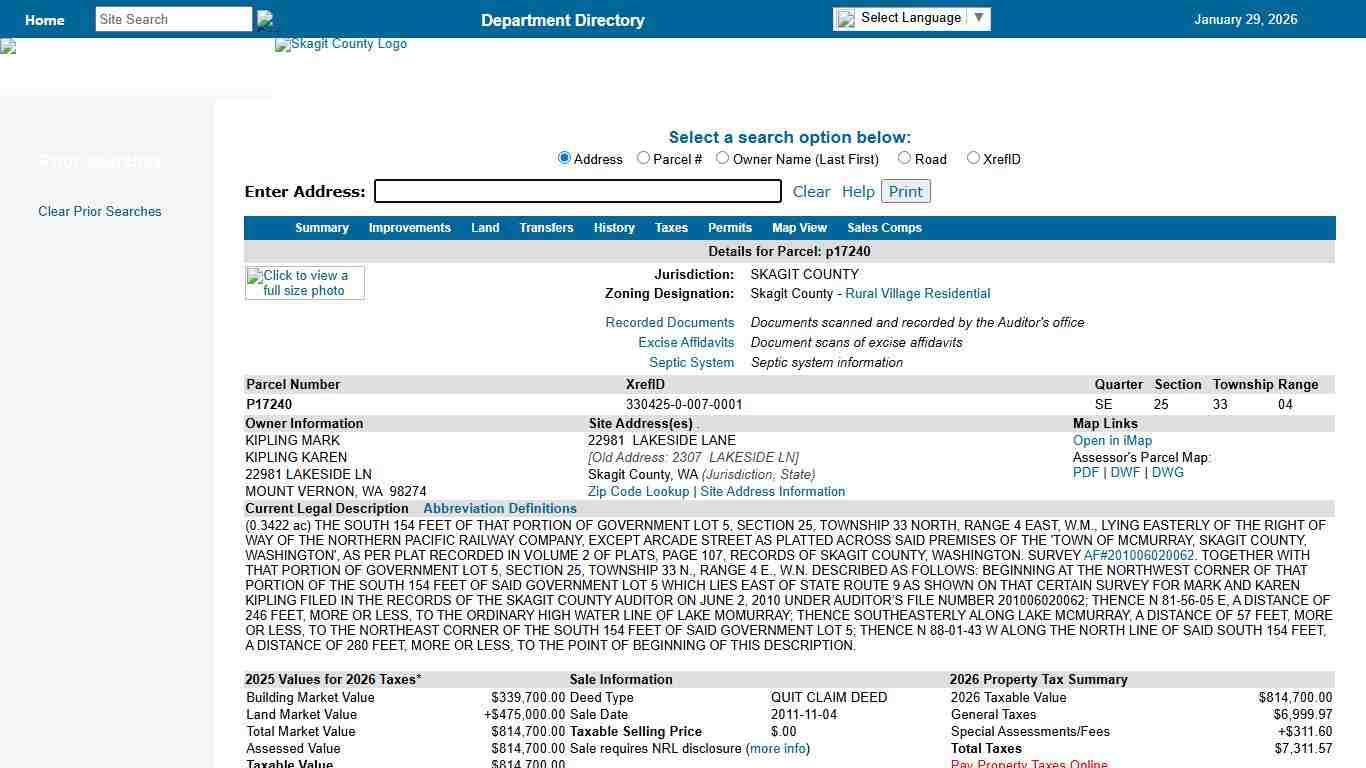

Skagit County Property Information

Property Search

Property Tax Summary. 2026 Taxes will be available after 2/15/2026 . Use the Taxes link below for 2025 taxes. Legal Description. Current Legal Description.

https://www.skagitcounty.net/search/property/default.aspx?id=p17240

EDASC Property Search

Property Search Looking for information on properties in Skagit County? The below property search tool can assist you in locating commercial and industrial real estate for sale and accessing information on all properties and parcels in Skagit County, regardless of whether they are currently on the market.

https://www.skagit.org/locate-here/property-search

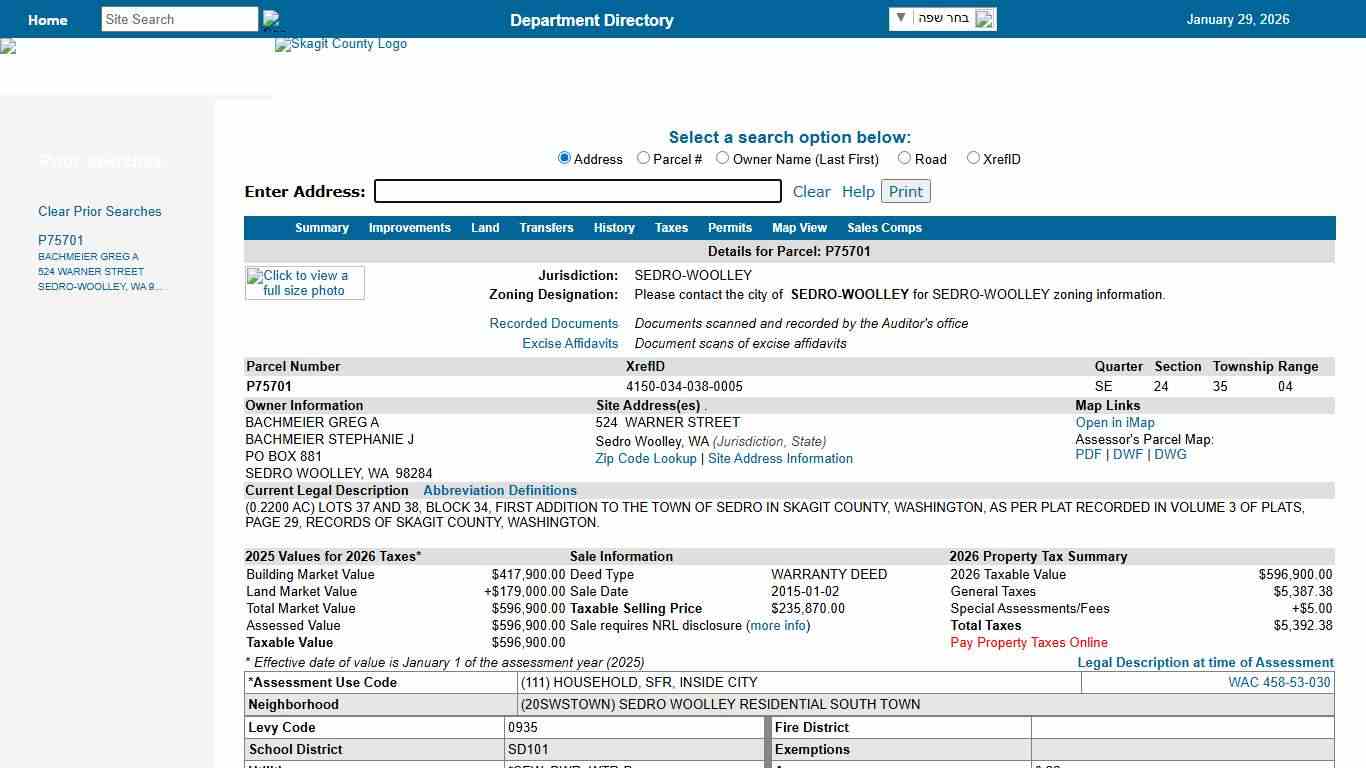

Property Search

2025 Values for 2026 Taxes. Building Market Value: $417,900.00 ; Sale Information. Deed Type: WARRANTY DEED ; Property Tax Summary. 2026Taxable Value: $596,900.00.

https://www.skagitcounty.net/Search/Property/?id=P75701

2026 Property Tax Calendar Due Dates

2026 Property Tax Calendar. January. All taxable real and personal property is ... Personal property listing forms are due April 30 to the county assessor.

https://dor.wa.gov/sites/default/files/2023-10/PropertyTaxCalendarDueDates.pdfSVH-710913 Res. No. 01-2026 Legal Announcements

Too Many Requests client_ip: 198.12.104.87 request_id: 32066901600...

https://www.goskagit.com/classifieds/community/announcements/legal/svh-710913-res-no-01-2026/pdfdisplayad_230b022a-2242-528a-ad3b-c814ddf81a4a.htmlSkagit County implements public safety sales tax Cascadia Daily News

Faced with a $19 million budget deficit going into 2026, Skagit County has joined other jurisdictions in the region by adopting a new 0.1% public safety sales tax. The tax, created this year by the state Legislature with House Bill 2015, gives local governments the ability to implement a new sales tax without asking for voter approval, as long as the law enforcement agencies that benefit from the funding meet...

https://www.cascadiadaily.com/2025/nov/11/skagit-county-implements-public-safety-sales-tax/

The preliminary... - Skagit County, Washington - Government Facebook

The preliminary 2026 Skagit County budget has been posted to the Budget and Finance Department website (linked below) for public review and comment. Written comments on the budget will be accepted through Monday, December 1st, at 4:30 p.m. The Commissioners are hosting a public hearing to take feedback on the preliminary budget on Monday, December 1st, at 10:00 a.m.

https://www.facebook.com/SkagitCountyWA/posts/the-preliminary-2026-skagit-county-budget-has-been-posted-to-the-budget-and-fina/1146888184282246/

Search Skagit County Public Property Records Online CourthouseDirect.com

These cookies enable the website to provide enhanced functionality and personalisation. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies then some or all of these services may not function properly.

https://www.courthousedirect.com/PropertySearch/Washington/Skagit

Skagit County Property Records Owners, Deeds, Permits

Instant Access to Skagit County, WA Property Records - Owner(s) - Deed Records - Loans & Liens - Values - Taxes - Building Permits - Purchase History - Property Details - And More! Skagit County, Washington, consists of eight cities, with Mount Vernon being the county seat and the largest.

https://washington.propertychecker.com/skagit-county

NETR Online • Skagit • Skagit Public Records, Search Skagit Records, Skagit Property Tax, Washington Property Search, Washington Assessor

Select: Skagit County Public Records The Evergreen State Skagit Assessor (360) 416-1780 Skagit Auditor / Recorder (360) 416-1700 Skagit Treasurer (360) 416-1750 Skagit NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store Comparable Properties Reports...

https://publicrecords.netronline.com/state/WA/county/skagit

Calendar • Property Tax Help

January 7, 2026 2026-01-07T18:00:00 1220 10th Street Anacortes, WA 98221 Property Tax Help Wednesday, January 7, 2026 Skagit County Assessor Danny Hagen will explain how Washington’s property tax system works and highlight resources available for seniors and people with disabilities. Skagit County Assessor Danny Hagen will explain how Washington’s property tax system works, what drives changes in tax bills, and how property values are determined.

https://www.anacorteswa.gov/calendar.aspx?EID=11409

Whatcom County Property Search

Whatcom County property search is not available at this time. The server is normally offline for updates between 1-4 AM. Sorry for the inconvenience. Please try again later. If you're receiving this error outside of those times, please use the link below to reload the page. If you're receiving this error outside of those times, please use the link below to reload the page.

https://property.whatcomcounty.us/propertyaccess/?cid=0

Assessor Services offered at Skagit County - Assessor's Office

Assessor Services offered at Skagit County - Assessor's Office Assessor Services offered at Skagit County - Assessor's Office 700 South 2nd Street, Room 204, Mount Vernon, WA 98273 Call or visit website. Vary. Skagit, WA Description The assessor values real property using one or more of the following appraisal methods: Market or sales comparison value is determined or estimated based on multiple sales of similar properties.

https://ccwa.doh.wa.gov/search/6054b954-a511-5e63-a803-02439e0d32ec

2026 Skagit County Sales Tax Rate - Avalara

Skagit County sales tax details The minimum combined 2026 sales tax rate for Skagit County, Washington is 8.6%. This is the total of state, county, and city sales tax rates. The Washington sales tax rate is currently 6.5%. The Skagit County sales tax rate is 0.0%.

https://www.avalara.com/taxrates/en/state-rates/washington/counties/skagit-county.html

IRS announces tax relief for taxpayers impacted by severe storms, straight-line winds, flooding, landslides, and mudslides in the State of Washington; various deadlines postponed to May 1, 2026 Internal Revenue Service

WA-2025-03 WASHINGTON — The Internal Revenue Service announced today tax relief for individuals and businesses in the State of Washington affected by severe storms, straight-line winds, flooding, landslides, and mudslides that began on Dec. 9, 2025. These taxpayers now have until May 1, 2026, to file various federal individual and business tax returns and make tax payments.

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-taxpayers-impacted-by-severe-storms-straight-line-winds-flooding-landslides-and-mudslides-in-the-state-of-washington-various-deadlines-postponed-to-may-1-2026

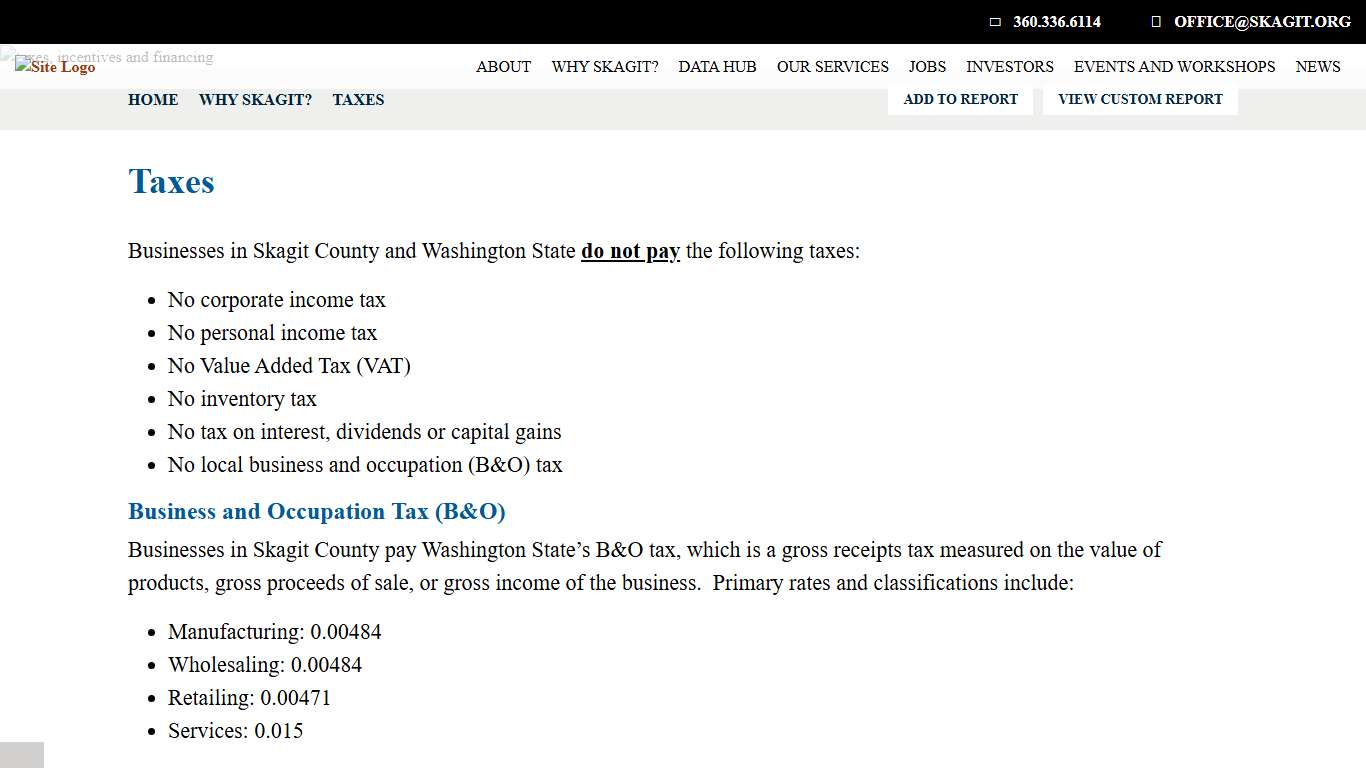

EDASC Taxes

Taxes Businesses in Skagit County and Washington State do not pay the following taxes: - No corporate income tax - No personal income tax - No Value Added Tax (VAT) - No inventory tax - No tax on interest, dividends or capital gains - No local business and occupation (B&O) tax Business and Occupation Tax (B&O) Businesses in Skagit County pay Washington State’s B&O tax, which is a gross receipts...

https://www.skagit.org/why-skagit/taxes